by Nicola Phillips, Copywriter

We’ve gotten questions lately about whether Soluna’s business model is still viable if Texas’s grid operator, ERCOT, keeps changing its rules. These questions are primarily in response to a new process ERCOT put in place this past spring. Here, we’ll demystify that process and what it means for Soluna moving forward.

First, a bit of background on how we got here.

In 1935, President Roosevelt passed the Federal Power Act, paving the way for regulation of interstate electricity transmission.

Texas responded by consolidating its two separate power systems into one statewide grid that could, in theory, be entirely self-sufficient (and thus dodge the new regulations invoked by crossing state lines).

Texas wasn’t the only state to attempt this, but no other state was able to sustain the level of generation needed to independently power themselves without external help.

Further federal regulations in 1970 prompted the Texas Interconnected System (TIC) to evolve into the system we know today, the Electric Reliability Council of Texas (ERCOT).

ERCOT today manages around 90% of power use across the state, and operates as a fully independent system, separate from the rest of the country.

Texas has historically been an energy mecca, leading the US in oil and natural gas production and boasting prodigious amounts of wind and sun. Over the years, Texas’s big gamble on self-sufficiency has largely panned out (the state has shown no signs of seeking to rejoin the interconnected grid systems in the US). ERCOT, however, has faced periodic criticism for mismanagement, especially in the wake of disasters like the February 2021 storm that resulted in rolling blackouts across the state.

The price of energy in Texas is also deregulated, meaning it’s only subject to the market forces of supply and demand. Deregulation tends to be appealing to developers, and Texas has attracted its fair share. The normal process for new loads that want to set up shop in Texas is to go through a Generation Interconnection Request (GINR) in order to connect to the grid.

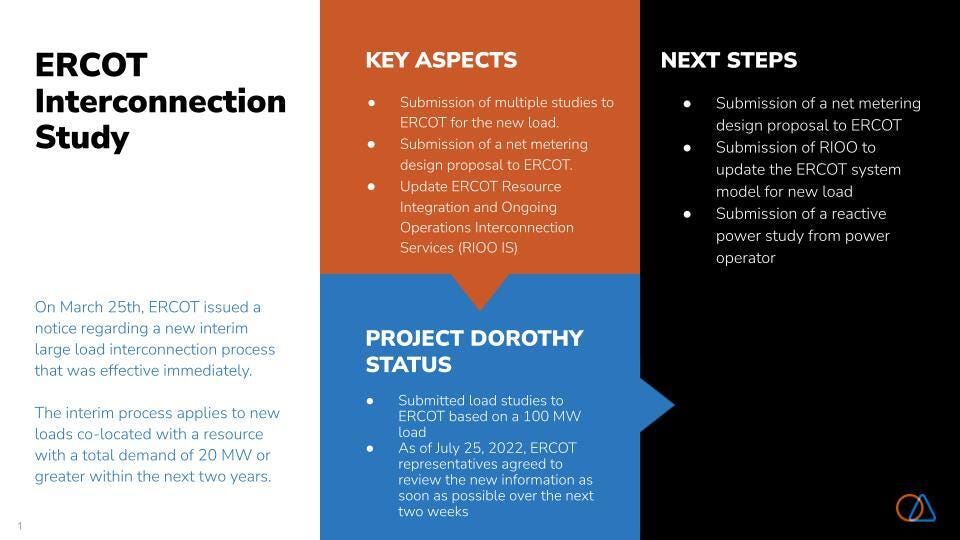

The Interim Large Load Interconnection Process

This spring, in response to a recent influx of large loads with fast electrification times, ERCOT announced an interim process to handle large loads, and assigned a special task force to oversee it.

The requirements are not particular to crypto miners, but the inundation of mining companies to Texas over the last two years was definitely a contributing factor.

Historically, large loads have taken one to two years to come to fruition. Many crypto mining operations can electrify in well under a year, and the sheer number of operations looking to power up within an expedited timeline strains an already loaded grid. ERCOT currently carries about 2 GW of load, and expects to add an additional 2 GW every year for the foreseeable future.

The interim large load task force is specifically focused on dealing with loads that meet one of several requirements:

- New loads not co-located with a resource with total demand within the next two years of 75 MW or greater;

- Existing loads not co-located with a resource increasing total demand by 75 MW or greater within the next two years;

- New loads co-located with a resource with total demand within the next two years of 20 MW or greater; or

- Existing loads co-located with a resource increasing total demand by 20 MW or greater within the next two years.

The team does a regional planning assessment and review to determine what effect this load is likely to have on the grid. A major factor they look at is transmission; namely, is there enough capacity to send energy out at a certain amount and enough capacity to draw energy in at a certain amount? In energy-dense areas that attract a swath of developers, this becomes an increasing concern as multiple projects might be vying for a finite amount of energy.

ERCOT estimates that projects undergoing the new process can expect it to take somewhere between a few weeks and a few months.

Soluna’s Positioning

Soluna is currently going through this process as we prepare to energize our flagship site in the state. We’re optimistic that there won’t be competing interest as the area in which we’re building has little demand from other major energy users (it’s mostly agricultural). That said, there’s a chance that ERCOT will say we need to phase in our planned load. In that scenario, we would energize in installments, beginning with perhaps as little as 20MW and expanding from there.

We’ve been encouraged by the collaboration we’ve seen thus far between ERCOT and developers seeking to energize new large load projects. Continuing to bring these different stakeholders together will be essential as Texas seeks to build a better, more resilient grid.

Our CEO John explains more in a recent installment of our#AMA series.

Watch here.