Project pipeline growth, cash growth, and capital structure simplification highlight the focus and execution in core business.

ALBANY, NY, April 1, 2025 – Soluna Holdings, Inc. (“Soluna Holdings” or the “Company”), (NASDAQ: SLNH), a developer of green data centers for intensive computing applications including Bitcoin mining and AI, announced financial results for the full year ended December 31, 2024.

“Our 2024 results reflect continued momentum and strong execution across our core businesses of Bitcoin hosting, mining, and demand response services,” said John Belizaire, CEO of Soluna Holdings.

“We broke ground on Project Dorothy 2, which will increase our Bitcoin Hosting capacity to 123 MW when fully ramped. We significantly expanded our project pipeline and launched our AI/HPC business to meet the growing demand for sustainable AI compute. These milestones mark a pivotal phase of growth and validate our long-term strategy to lead the next wave of clean, efficient infrastructure for Bitcoin Hosting and AI,” continued John Belizaire.

“We terminated our HPE GPU-as-a-Service contract to mitigate losses seen in the second half of 2024 and enable us to focus on the growth of our substantial pipeline of projects into AI/HPC data centers during 2025, beginning with Project Kati,” said John Tunison, CFO of Soluna Holdings.

“Additionally, we have made substantial progress towards simplifying our capital structure, including reducing our Convertible Loan Notes to zero and securing modifications to the terms of our Series B Preferred Stock, which we believe strengthens our ability to raise the growth capital needed to execute on our strategic plan and has resulted in positive cash flow from our core business for the first time,” continued John Tunison.

2024 Operational and Corporate Highlights:

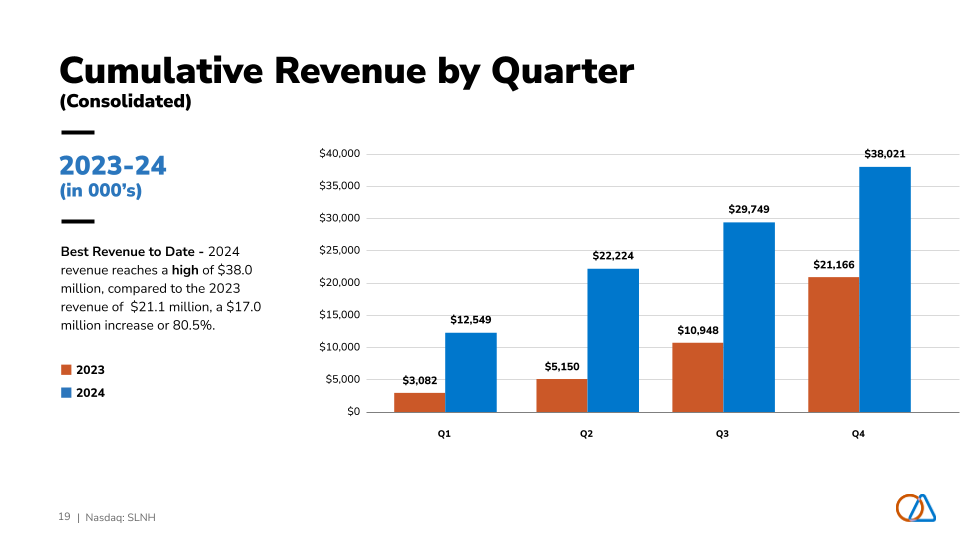

- Record revenue grew by 80.5%, reaching $38.0 million, compared to $21.1 million in 2023.

- Our sites operated at a high operational efficiency and produced strong financial results despite the “halving” of Bitcoin in April 2024.

- Project Dorothy 1A and 1B were online for the full year of 2024, generating $13.7 million and $17.0 million in Bitcoin hosting and mining revenue, respectively.

- Demand Response Services (“DRS”) commenced in December 2023 and generated $2.1 million in revenue in 2024, following substantial development and preparation over the prior year.

- Total revenue grew by 9.9% to $8.3 million in Q4 2024 compared to Q3 2024, driven by higher hash price and change in customers with higher profitability.

- Capital raised at Soluna Holdings and at the Data Center Projects exceeded $31.5 million – $2.3 million in warrant exercises and $29.2 million between Soluna AL CloudCo, LLC (“CloudCo” or “Project Ada”), a wholly owned subsidiary of Soluna Cloud, Inc. (“Cloud”), and Project Dorothy 2 in the form of debt and equity, respectively.

- Soluna Digital achieved a quarterly gross profit of $2.6 million, or 31.0%, in Q4 2024 compared to $1.5 million, or 19.9%, in Q3 2024.

- Current & Restricted Cash maintained at $10.5 million at the end of 2024, while unrestricted cash grew by 23.2% to $7.8 million from the end of 2023.

- We simplified our capital structure by fully converting Convertible Loan Notes and significantly restructuring the Preferred B equity.

- Construction of Project Dorothy 2 started in the third quarter of 2024, and the initial phase of powering up is underway, which aims to increase our Bitcoin hosting capacity by 64.0%, reaching a total of 123 MW, which is expected to be fully completed by Q4 2025.

- Project Kati successfully exited the ERCOT planning phase, which is expected to unlock up to 166 MW of new Bitcoin hosting and AI joint venture opportunities for the Company.

- Term Sheets for Power for Project Rosa in 2024 and a land agreement were subsequently secured in early 2025, which is expected to unlock up to 187 MW of new Bitcoin hosting and AI joint venture opportunities for Soluna Holdings.

“I am honored to lead this team,” John Belizaire continued. “Their dedication and grit have been the driving force behind our continued momentum and success.”

- Growth Capital Secured by entering into the Standby Equity Purchase Agreement (SEPA) – In Q4 2024, the Company filed a registration statement for the resale of the shares of common stock in connection with the $25 million SEPA entered into with Yorkville Advisors Global L.P. in August 2024. In early 2025, the registration statement was declared effective by the SEC, enabling us to raise capital to pay debt, invest in data center projects, and for working capital and general corporate purposes.

- CloudCo completed a strategic termination of the Hewlett Packard Enterprise Company (“HPE”) contract – Recognizing the 2024 downtrend in market pricing and softening demand for GPU-as-a-Service in small clusters, in March 2025, the Company’s indirect subsidiary, CloudCo terminated the HPE contract to access Nvidia GPUs and recorded a loss on contract of $28.6 million which is the sum of future payments due under the contract and the full write down of the prepaid asset. The strategic termination of the contract enables us to refocus on Bitcoin and the future development of AI data centers at our Projects. Following CloudCo’s termination, HPE terminated the contract for cause, effective immediately.

Fourth Quarter 2024 Financial Results :

- Steady Revenue Growth – Revenue grew to $8.3 million compared to Q3 2024 revenue of $7.5 million, a 9.9% increase due to higher hash price and change of customers with higher profitability.

- Strong Cash Balance Continues – Current Cash & Restricted Cash as of December 31, 2024, was $10.5 million, while unrestricted cash grew by 23.2% to $7.8 million from the end of 2023.

- Continuous Growth of Gross Profit – excluding Project Ada / Cloud, gross profit improved over Q3 2024 by $1.1 million, driven by higher hash price and lower electricity costs.

- Selling, General & Administrative Expenses – was relatively flat quarter over quarter in 2024 and fourth quarter year over year, excluding a quarterly bonus true up.

Fiscal Year 2024 Financial Results:

- Strong Revenue Increase – Driven by the first full year with Project Dorothy 1A/1B online, FY 2024 revenue reached $38.0 million, compared to $21.1 million FY 2023, a $16.9 million or 80.5% increase. Additionally, in 2024, DRS delivered $2.1 million of revenue.

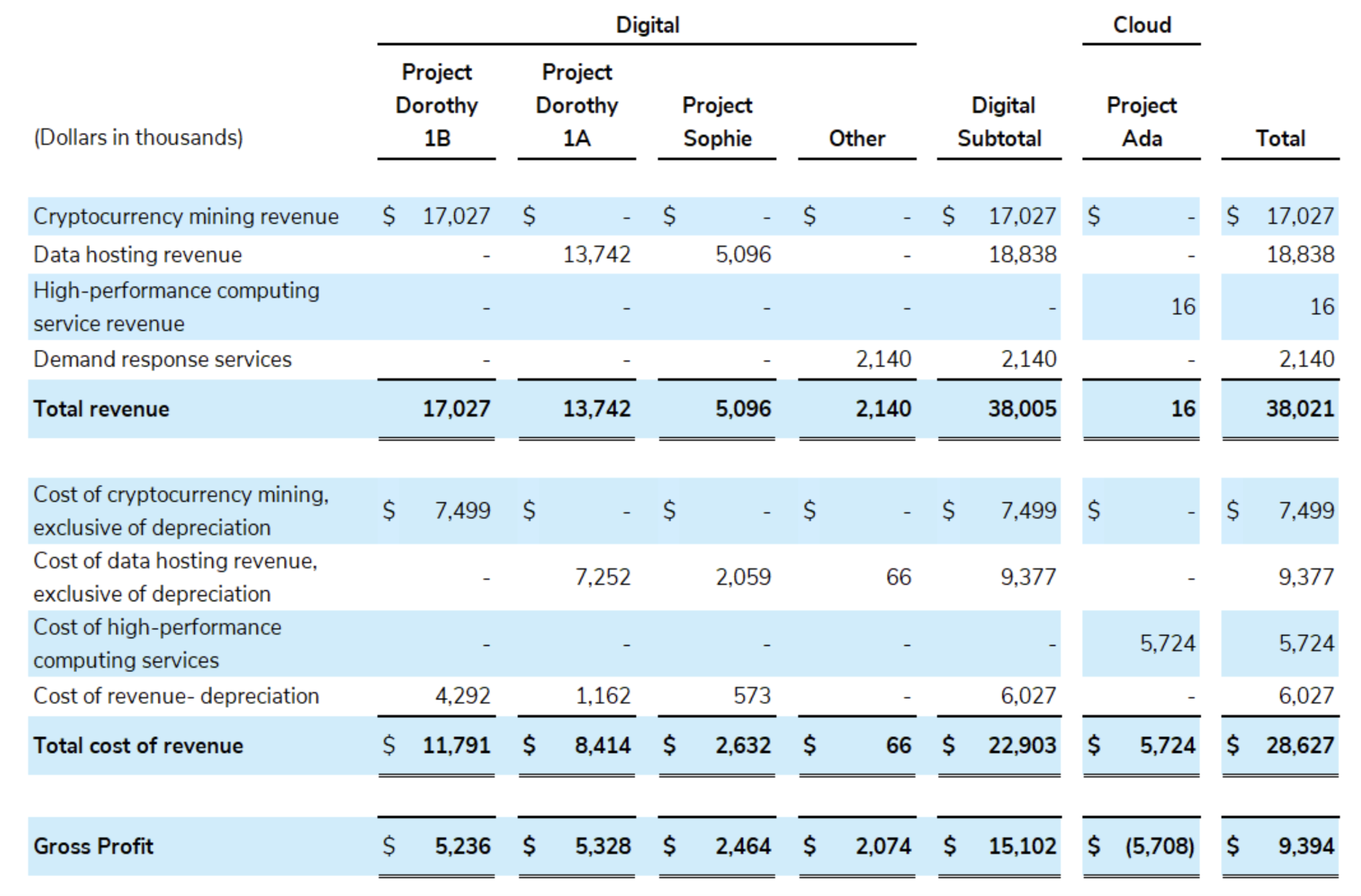

- Gross Profit Resilience in Core Business – Excluding the loss of $5.7 million related to the costs of the Project Ada / Cloud business, annual gross profit grew by $9.9 million from $5.2 million in FY 2023 to $15.1 million in FY 2024, driven by the full year with Project Dorothy 1A/1B online and DRS.

- Consistent Gross Margin – For 2024, the business demonstrated its core strength as gross margin growth from Bitcoin Mining and Hosting, and Demand Response Services essentially offset losses related to Project Ada / Cloud, resulting in a flat year-over-year consolidated gross margin of 25.0%.

- Resilient Adjusted EBITDA – 2024 Adjusted EBITDA is $0.9 million, compared to the 2023 loss of $3.5 million; an increase of $4.4 million driven by continued revenue growth despite downward market pressure on price and volume from the scheduled Bitcoin halving and early phase, pre-revenue, Project Ada / Cloud losses.

- Unrestricted Cash Growth – Unrestricted cash increased 23.2% from the end of FY 2023, reaching $7.8 million.

FY 2024 Revenue & Cost of Revenue by Project Site

FY 2023 Revenue & Cost of Revenue by Project Site

- Selling, General & administrative expenses grew by $3.3 million for the year ended December 31, 2024, as expected, through expanded hiring of key talent, consulting, and compliance costs – driven by company growth and progressing the company’s strategy.

- Salary and wages increased by approximately $0.6 million during the year ended December 31, 2024 due to an increase in resources and salaries.

- Stock Compensation Expense increased by $1.4 million during the year ended December 31, 2024. We issued grants in April, June, September, and December of 2024, in which some of the grants provided for immediate vesting, therefore further increasing the expense compared to prior comparable periods. In addition, some of the expenses were due to the cancellation and replacement of certain options.

- Credit provisioning of bad debt expenses increased by $0.8 million during the year ended December 31, 2024, which was attributable to the termination of a customer hosting contract, which included the settlement expense and a reserve for a note receivable following the sale of Soluna Computing, Inc was recorded.

For more detail on the HPE contract termination, see 8-K filing dated March 28, 2025. The audited financial statements and 10K are available online.

A narrative overview of our 2024 Highlights can be found on our website.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. Other examples of forward-looking statements may include, but are not limited to, (i) statements of Company plans and objectives, including the completion of Project Dorothy 2, our expectations with respect to the amount of renewable energy capacity Projects Kati, Rosa and Dorothy 2 will deliver, the completion of the land purchase for Project Rosa, and a refocus of our business strategy on Bitcoin and future development of AI data centers, (ii) statements of future economic performance, and (iii) statements of assumptions underlying other statements about the Company or its business. Soluna Holdings may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (“SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve inherent risks and uncertainties, further information regarding which is included in the Company’s filings with the SEC. All information provided in this press release is as of the date of the press release, and Soluna Holdings undertakes no duty to update such information, except as required under applicable law.

Non GAAP Measures

In addition to figures prepared in accordance with GAAP, Soluna Holdings from time to time presents alternative non-GAAP performance measures, e.g., EBITDA and Adjusted EBITDA. EBITDA is defined as earnings before interest, taxes, and depreciation and amortization. Adjusted EBITDA is defined as EBITDA adjusted for stock-based compensation costs, loss on sale of fixed assets, loss on debt extinguishment and revaluation, placement agent release expense, loss on contract, provision for credit losses, convertible note inducement expense and impairment on fixed assets. EBITDA and Adjusted EBITDA are provided in addition to and should not be considered to be substitutes for, or superior to net income, the comparable measure calculated in accordance with GAAP. Further, EBITDA and Adjusted EBITDA should not be considered as alternatives to revenue growth, net income, or any other performance measure calculated in accordance with GAAP, or as alternatives to cash flow from operating activities as a measure of our liquidity. Alternative performance measures are not subject to GAAP or any other generally accepted accounting principle. Other companies may define these terms in different ways. See our annual report on Form 10-K for the year ended December 31, 2024 for an explanation of how management uses these measures in evaluating its operations. Investors should review the non-GAAP reconciliations provided below and not rely on any single financial measure to evaluate the Company’s business.

About Soluna Holdings, Inc (Nasdaq: SLNH)

Soluna Holdings is on a mission to make renewable energy a global superpower using computing as a catalyst. The company designs, develops, and operates digital infrastructure that transforms surplus renewable energy into global computing resources. Soluna Holdings’ pioneering data centers are strategically co-located with wind, solar, or hydroelectric power plants to support high-performance computing applications including Bitcoin Mining, Generative AI, and other compute-intensive applications. Soluna Holdings’ proprietary software MaestroOS(™) helps energize a greener grid while delivering cost-effective and sustainable computing solutions, and superior returns. To learn more visit solunacomputing.com and follow us on:

LinkedIn: https://www.linkedin.com/company/solunaholdings/

X (formerly Twitter): x.com/solunaholdings

YouTube: youtube.com/c/solunacomputing

Newsletter: bit.ly/solunasubscribe

Resource Center: solunacomputing.com/resources

Contact Information

John Tunison

Chief Financial Officer

Soluna Holdings, Inc.

jtunison@soluna.io

Soluna Holdings, Inc. and Subsidiaries

Consolidated Balance Sheets

As of December 31, 2024 and December 31, 2023

|

(Dollars in thousands, except per share) |

|

December 31, 2024 |

|

|

December 31, 2023 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

7,843 |

|

|

$ |

6,368 |

|

|

Restricted cash |

|

|

1,150 |

|

|

|

2,999 |

|

|

Accounts receivable, net (allowance for expected credit losses $244 and $0 as of December 31, 2024 and December 31, 2023) |

|

|

2,693 |

|

|

|

2,948 |

|

|

Notes receivable |

|

|

13 |

|

|

|

446 |

|

|

Prepaid expenses and other current assets |

|

|

1,768 |

|

|

|

1,416 |

|

|

Equipment held for sale |

|

|

28 |

|

|

|

107 |

|

|

Total Current Assets |

|

|

13,495 |

|

|

|

14,284 |

|

|

Restricted cash, noncurrent |

|

|

1,460 |

|

|

|

1,000 |

|

|

Other assets |

|

|

2,724 |

|

|

|

2,954 |

|

|

Deposits and credits on equipment |

|

|

5,145 |

|

|

|

1,028 |

|

|

Property, plant and equipment, net |

|

|

47,283 |

|

|

|

44,572 |

|

|

Intangible assets, net |

|

|

17,620 |

|

|

|

27,007 |

|

|

Operating lease right-of-use assets |

|

|

313 |

|

|

|

431 |

|

|

Total Assets |

|

$ |

88,040 |

|

|

$ |

91,276 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

2,840 |

|

|

$ |

2,099 |

|

|

Accrued liabilities |

|

|

29,075 |

|

|

|

4,906 |

|

|

Convertible notes payable |

|

|

– |

|

|

|

8,474 |

|

|

Current portion of debt |

|

|

14,444 |

|

|

|

10,864 |

|

|

Income tax payable |

|

|

37 |

|

|

|

24 |

|

|

Customer deposits-current |

|

|

1,416 |

|

|

|

1,588 |

|

|

Operating lease liability |

|

|

61 |

|

|

|

220 |

|

|

Total Current Liabilities |

|

|

47,873 |

|

|

|

28,175 |

|

|

|

|

|

|

|

|

|

|

|

|

Other liabilities |

|

|

235 |

|

|

|

499 |

|

|

Customer deposits- long-term |

|

|

– |

|

|

|

1,248 |

|

|

Long-term debt |

|

|

7,061 |

|

|

|

– |

|

|

Operating lease liability |

|

|

252 |

|

|

|

216 |

|

|

Deferred tax liability, net |

|

|

5,257 |

|

|

|

7,779 |

|

|

Total Liabilities |

|

|

60,678 |

|

|

|

37,917 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 13) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

|

9.0% Series A Cumulative Perpetual Preferred Stock, par value $0.001 per share, $25.00 liquidation preference; authorized 6,040,000; 4,953,545 and 3,061,245 shares issued and outstanding as of December 31, 2024 and December 31, 2023 |

|

|

5 |

|

|

|

3 |

|

|

Series B Preferred Stock, par value $0.0001 per share, authorized 187,500; 62,500 shares issued and outstanding as of December 31, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, par value $0.001 per share, authorized 75,000,000; 10,647,761 shares issued and 10,607,020 shares outstanding as of December 31, 2024 and 2,546,361 shares issued and 2,505,620 shares outstanding as of December 31, 2023 |

|

|

11 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

|

315,607 |

|

|

|

291,276 |

|

|

Accumulated deficit |

|

|

(314,304) |

|

|

|

(250,970) |

|

|

Common stock in treasury, at cost, 40,741 shares at December 31, 2024 and December 31, 2023 |

|

|

(13,798) |

|

|

|

(13,798) |

|

|

Total Soluna Holdings, Inc. Stockholders’ (Deficit) Equity |

|

|

(12,479) |

|

|

|

26,514 |

|

|

Non-Controlling Interest |

|

|

39,841 |

|

|

|

26,845 |

|

|

Total Stockholders’ Equity |

|

|

27,362 |

|

|

|

53,359 |

|

|

Total Liabilities and Stockholders’ Equity |

|

$ |

88,040 |

|

|

$ |

91,276 |

|

Soluna Holdings, Inc. and Subsidiaries

Consolidated Statements of Operations

For the Years Ended December 31, 2024 and 2023

(Dollars in thousands, except per share)

|

|

|

Year Ended |

|

|||||

|

|

|

December 31, |

|

|||||

|

(Dollars in thousands, except per share) |

|

2024 |

|

|

2023 |

|

||

|

|

|

|

|

|

|

|

||

|

Cryptocurrency mining revenue |

|

$ |

17,027 |

|

|

$ |

10,602 |

|

|

Data hosting revenue |

|

|

18,838 |

|

|

|

10,196 |

|

|

High-performance computing service revenue |

|

|

16 |

|

|

|

– |

|

|

Demand response service revenue |

|

|

2,140 |

|

|

|

268 |

|

|

Total revenue |

|

|

38,021 |

|

|

|

21,066 |

|

|

Operating costs: |

|

|

|

|

|

|

|

|

|

Cost of cryptocurrency mining revenue, exclusive of depreciation |

|

|

7,499 |

|

|

|

6,365 |

|

|

Cost of data hosting revenue, exclusive of depreciation |

|

|

9,377 |

|

|

|

5,601 |

|

|

Cost of high-performance computing services |

|

|

5,724 |

|

|

|

– |

|

|

Cost of cryptocurrency mining revenue- depreciation |

|

|

4,292 |

|

|

|

2,696 |

|

|

Cost of data hosting revenue- depreciation |

|

|

1,735 |

|

|

|

1,167 |

|

|

Total cost of revenue |

|

|

28,627 |

|

|

|

15,829 |

|

|

Operating expenses: |

|

|

|

|

|

|

||

|

General and administrative expenses, exclusive of depreciation and amortization |

|

|

18,581 |

|

|

|

15,390 |

|

|

Depreciation and amortization associated with general and administrative expenses |

|

|

9,613 |

|

|

|

9,513 |

|

|

Total general and administrative expenses |

|

|

28,194 |

|

|

|

24,903 |

|

|

Loss on contract |

|

|

28,593 |

|

|

|

– |

|

|

Impairment on fixed assets |

|

|

130 |

|

|

|

575 |

|

|

Operating loss |

|

|

(47,523) |

|

|

|

(20,241) |

|

|

Interest expense |

|

|

(2,527) |

|

|

|

(2,748) |

|

|

Loss on debt extinguishment and revaluation, net |

|

|

(7,349) |

|

|

|

(3,904) |

|

|

Loss on sale of fixed assets |

|

|

(31) |

|

|

|

(398) |

|

|

Other expense, net |

|

|

(3,357) |

|

|

|

(1,479) |

|

|

Loss before income taxes |

|

|

(60,787) |

|

|

|

(28,770) |

|

|

Income tax benefit, net |

|

|

2,487 |

|

|

|

1,067 |

|

|

Net loss |

|

|

(58,300) |

|

|

|

(27,703) |

|

|

(Less) Net income attributable to non-controlling interest, net |

|

|

(5,034) |

|

|

|

(1,498) |

|

|

Net loss attributable to Soluna Holdings, Inc. |

|

$ |

(63,334) |

|

|

$ |

(29,201) |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted loss per common share: |

|

|

|

|

|

|

|

|

|

Basic & Diluted loss per share |

|

$ |

(12.15) |

|

|

$ |

(27.79) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding (Basic and Diluted) |

|

|

6,280,915 |

|

|

|

1,313,718 |

|

Soluna Holdings, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

For the Year Ended December 31, 2024 and 2023

(Dollars in thousands)

|

|

|

Year Ended December 31, |

|

|||||

|

(Dollars in thousands) |

|

2024 |

|

|

2023 |

|

||

|

Operating Activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(58,300) |

|

|

$ |

(27,703) |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

6,152 |

|

|

|

3,894 |

|

|

Amortization expense |

|

|

9,488 |

|

|

|

9,483 |

|

|

Stock-based compensation |

|

|

5,311 |

|

|

|

4,312 |

|

|

Deferred income taxes |

|

|

(2,522) |

|

|

|

(1,107) |

|

|

Impairment on fixed assets |

|

|

130 |

|

|

|

575 |

|

|

Provision for credit losses |

|

|

760 |

|

|

|

– |

|

|

Amortization of operating lease asset |

|

|

133 |

|

|

|

238 |

|

|

Debt issuance costs |

|

|

2,011 |

|

|

|

– |

|

|

Loss on debt extinguishment and revaluation, net |

|

|

7,349 |

|

|

|

3,904 |

|

|

Loss on contract |

|

|

28,593 |

|

|

|

– |

|

|

Amortization on deferred financing costs and discount on notes |

|

|

351 |

|

|

|

753 |

|

|

Loss on sale of fixed assets |

|

|

31 |

|

|

|

398 |

|

|

Conversion inducement expense |

|

|

388 |

|

|

|

– |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(505) |

|

|

|

(2,620) |

|

|

Prepaid expenses and other current assets |

|

|

(3,296) |

|

|

|

(306) |

|

|

Other long-term assets |

|

|

(4,842) |

|

|

|

(304) |

|

|

Accounts payable |

|

|

741 |

|

|

|

(862) |

|

|

Deferred revenue |

|

|

– |

|

|

|

(453) |

|

|

Operating lease liabilities |

|

|

(138) |

|

|

|

(234) |

|

|

Other liabilities and customer deposits |

|

|

(1,671) |

|

|

|

3,156 |

|

|

Accrued liabilities |

|

|

4,767 |

|

|

|

3,889 |

|

|

Net cash used in operating activities |

|

|

(5,069) |

|

|

|

(2,987) |

|

|

Investing Activities |

|

|

|

|

|

|

|

|

|

Purchases of property, plant, and equipment |

|

|

(9,160) |

|

|

|

(12,705) |

|

|

Purchases of intangible assets |

|

|

(101) |

|

|

|

(58) |

|

|

Proceeds from disposal on property, plant, and equipment |

|

|

215 |

|

|

|

2,286 |

|

|

Deposits of equipment, net |

|

|

(4,117) |

|

|

|

147 |

|

|

Net cash used in investing activities |

|

|

(13,163) |

|

|

|

(10,330) |

|

|

Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from common stock warrant exercises |

|

|

2,332 |

|

|

|

– |

|

|

Proceeds from common stock securities purchase agreement offering |

|

|

– |

|

|

|

817 |

|

|

Proceeds from notes and debt issuance |

|

|

14,470 |

|

|

|

3,100 |

|

|

Payments on debt principal |

|

|

(2,675) |

|

|

|

(1,057) |

|

|

Payments on debt issuance costs |

|

|

(899) |

|

|

|

– |

|

|

Payments on other financing costs |

|

|

(1,375) |

|

|

|

– |

|

|

Costs of common stock securities purchase agreement offering |

|

|

– |

|

|

|

(10) |

|

|

Payments on NYDIG loans and line of credit |

|

|

– |

|

|

|

(350) |

|

|

Contributions from non-controlling interest |

|

|

14,735 |

|

|

|

20,365 |

|

|

Distributions to non-controlling interest |

|

|

(8,270) |

|

|

|

(1,002) |

|

|

Net cash provided by financing activities |

|

|

18,318 |

|

|

|

21,863 |

|

|

|

|

|

|

|

|

|

|

|

|

Increase in cash & restricted cash |

|

|

86 |

|

|

|

8,546 |

|

|

Cash & restricted cash – beginning of period |

|

|

10,367 |

|

|

|

1,821 |

|

|

Cash & restricted cash – end of period |

|

$ |

10,453 |

|

|

$ |

10,367 |

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information |

|

|

|

|

|

|

|

|

|

Cash paid during the period for: |

|

|

|

|

|

|

|

|

|

Interest paid on NYDIG loans and line of credit |

|

|

115 |

|

|

|

6 |

|

|

Interest paid on Navitas loan and June and July SPA notes |

|

|

412 |

|

|

|

204 |

|

|

Interest paid on convertible noteholder default |

|

|

– |

|

|

|

617 |

|

|

Non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

Warrant consideration in relation to convertible notes, Cloud notes, and revaluation of warrant liability |

|

|

6,362 |

|

|

|

1,673 |

|

|

Notes converted to common stock |

|

|

9,001 |

|

|

|

6,013 |

|

|

Noncash membership distribution accrual |

|

|

1,179 |

|

|

|

517 |

|

|

SEPA commitment payment |

|

|

275 |

|

|

|

– |

|

|

Placement agent release payment |

|

|

1,000 |

|

|

|

– |

|

|

Equipment loan converted to equity |

|

|

2,160 |

|

|

|

– |

|

|

Noncash disposal of NYDIG collateralized equipment |

|

|

– |

|

|

|

3,137 |

|

|

Promissory note and interest conversion to common shares |

|

|

– |

|

|

|

845 |

|

|

Interest and penalty settled through repossession of collateralized equipment |

|

|

– |

|

|

|

1,773 |

|

|

Noncash non-controlling interest contributions |

|

|

– |

|

|

|

2,095 |

|

|

Noncash activity right-of-use assets obtained in exchange for lease obligations |

|

|

146 |

|

|

|

403 |

|

|

Series B preferred dividend in accrued expense |

|

|

– |

|

|

|

656 |

|

|

Noncash note receivable from sale of equipment |

|

|

– |

|

|

|

240 |

|

Reconciliations of EBITDA and Adjusted EBITDA to net loss, the most comparable GAAP financial metric, for historical periods are presented in the table below:

|

(Dollars in thousands) |

|

Years Ended December 31, |

|

|||||

|

|

|

2024 |

|

|

2023 |

|

||

|

|

|

|

|

|

|

|

||

|

Net loss from continuing operations |

|

$ |

(58,300) |

|

|

$ |

(27,703) |

|

|

Interest expense |

|

|

2,527 |

|

|

|

2,748 |

|

|

Income tax (benefit) expense |

|

|

(2,487) |

|

|

|

(1,067) |

|

|

Depreciation and amortization |

|

|

15,640 |

|

|

|

13,376 |

|

|

EBITDA |

|

|

(42,620) |

|

|

|

(12,646) |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: Non-cash items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation costs |

|

|

5,311 |

|

|

|

4,312 |

|

|

Loss on sale of fixed assets |

|

|

31 |

|

|

|

398 |

|

|

Loss on debt extinguishment and revaluation, net |

|

|

7,349 |

|

|

|

3,904 |

|

|

Placement agent release expense |

|

|

1,000 |

|

|

|

– |

|

|

Loss on contract |

|

|

28,593 |

|

|

|

– |

|

|

Provision for credit losses |

|

|

760 |

|

|

|

– |

|

|

Convertible note inducement expense |

|

|

388 |

|

|

|

– |

|

|

Impairment on fixed assets |

|

|

130 |

|

|

|

575 |

|

|

Adjusted EBITDA |

|

$ |

942 |

|

$ |

(3,457) |

|

|

The following table represents the EBITDA and Adjusted EBITDA activity between each three-month period from January 1, 2024 through December 31, 2024.

|

(Dollars in thousands) |

|

Three months ended March 31, 2024 |

|

|

Three months ended June 30, 2024 |

|

|

Three months ended September 30, 2024 |

|

|

Three months ended December 31, 2024 |

|

|

Year ended December 31, 2024 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Net loss from continuing operations |

|

$ |

(2,544) |

|

|

$ |

(9,145) |

|

|

$ |

(8,093) |

|

|

$ |

(38,518) |

|

|

$ |

(58,300) |

|

|

Interest expense, net |

|

|

424 |

|

|

|

449 |

|

|

|

821 |

|

|

|

833 |

|

|

|

2,527 |

|

|

Income tax (benefit) expense from continuing operations |

|

|

(548) |

|

|

|

(649) |

|

|

|

(547) |

|

|

|

(743) |

|

|

|

(2,487) |

|

|

Depreciation and amortization |

|

|

3,926 |

|

|

|

3,909 |

|

|

|

3,916 |

|

|

|

3,889 |

|

|

|

15,640 |

|

|

EBITDA |

|

|

1,258 |

|

|

|

(5,436) |

|

|

|

(3,903) |

|

|

|

(34,539) |

|

|

|

(42,620) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: Non-cash items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation costs |

|

|

661 |

|

|

|

1,368 |

|

|

|

1,257 |

|

|

|

2,025 |

|

|

|

5,311 |

|

|

Loss on sale of fixed assets |

|

|

1 |

|

|

|

21 |

|

|

|

– |

|

|

|

9 |

|

|

|

31 |

|

|

Provision for credit losses |

|

|

– |

|

|

|

244 |

|

|

|

367 |

|

|

|

149 |

|

|

|

760 |

|

|

Convertible note inducement expense |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

388 |

|

|

|

388 |

|

|

Placement agent release expense |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

1,000 |

|

|

|

1,000 |

|

|

Loss on contract |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

28,593 |

|

|

|

28,593 |

|

|

Impairment on fixed assets |

|

|

130 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

130 |

|

|

Loss on debt extinguishment and revaluation, net |

|

|

3,097 |

|

|

|

5,600 |

|

|

|

(1,203) |

|

|

|

(145) |

|

|

|

7,349 |

|

|

Adjusted EBITDA |

|

$ |

5,147 |

|

|

$ |

1,797 |

|

|

$ |

(3,482) |

|

|

$ |

(2,520) |

|

$ |

942 |

||

The following table represents the EBITDA and Adjusted EBITDA activity between each three-month period from January 1, 2023 through December 31, 2023.

|

(Dollars in thousands) |

|

Three months ended March 31, 2023 |

|

|

Three months ended June 30, 2023 |

|

|

Three months ended September 30, 2023 |

|

|

Three months ended December 31, 2023 |

|

|

Year ended December 31, 2023 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Net loss from continuing operations |

|

$ |

(7,432) |

|

|

$ |

(9,257) |

|

|

$ |

(6,016) |

|

|

$ |

(4,998) |

|

|

$ |

(27,703) |

|

|

Interest expense, net |

|

|

1,374 |

|

|

|

486 |

|

|

|

495 |

|

|

|

393 |

|

|

|

2,748 |

|

|

Income tax (benefit) expense from continuing operations |

|

|

(547) |

|

|

|

(547) |

|

|

|

569 |

|

|

|

(542) |

|

|

|

(1,067) |

|

|

Depreciation and amortization |

|

|

3,002 |

|

|

|

2,918 |

|

|

|

3,579 |

|

|

|

3,877 |

|

|

|

13,376 |

|

|

EBITDA |

|

|

(3,603) |

|

|

|

(6,400) |

|

|

|

(1,373) |

|

|

|

(1,270) |

|

|

|

(12,646) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: Non-cash items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation costs |

|

|

879 |

|

|

|

2,232 |

|

|

|

595 |

|

|

|

606 |

|

|

|

4,312 |

|

|

Loss (gain) on sale of fixed assets |

|

|

78 |

|

|

|

(48) |

|

|

|

373 |

|

|

|

(5) |

|

|

|

398 |

|

|

Impairment on fixed assets |

|

|

209 |

|

|

|

169 |

|

|

|

41 |

|

|

|

156 |

|

|

|

575 |

|

|

Loss on debt extinguishment and revaluation, net |

|

|

(473) |

|

|

|

2,054 |

|

|

|

769 |

|

|

|

1,554 |

|

|

|

3,904 |

|

|

Adjusted EBITDA |

|

$ |

(2,910) |

|

|

$ |

(1,993) |

|

|

$ |

405 |

|

|

$ |

1,041 |

|

|

$ |

(3,457) |

|