Forward Looking Statements

This series of “Frequently Asked Questions” contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements include all statements, other than statements of historical fact, regarding our current views and assumptions with respect to future events regarding our business, our expectations with respect to the termination of the HPE Agreement, and other statements that are predictive in nature. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “estimates,” “confident” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the Securities and Exchange Commission (“SEC”), in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including but not limited to statements about the Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, further information regarding which is included in the Company’s filings with the SEC. All information provided in this series of “Frequently Asked Questions” is as of the dates indicated herein, and the Company undertakes no duty to update such information, except as required under applicable law.

What Happened? A Summary of Subsequent Event related to HPE

In 2024, Soluna Holdings, Inc. (“Soluna” or the “Company”) launched its GPU-as-a-Service business under its subsidiary, Soluna Cloud, Inc. (“Soluna Cloud”), with two primary objectives: (1) to gain commercial experience in the AI/HPC market in support of future data center development focused on large language models (LLMs) and other AI workloads; and (2) to capitalize on lower-cost capital to pursue high-growth revenue opportunities in the compute infrastructure market.

As a point of entry into the market, Soluna AL CloudCo LLC(“Soluna AL Cloud”), a wholly owned subsidiary of Soluna Cloud entered into a contract with Hewlett Packard Enterprise (“HPE”) on June 18, 2024 (“HPE Agreement”) that provided access to GPU clusters to service the emerging Generative AI/HPC market.

At the time of launch, the market for NVIDIA H100 GPU clusters was characterized by constrained supply and strong pricing, which aligned with the economics of Soluna’s fixed-cost hardware procurement agreement with HPE. However, by the end of 2024, the GPU market shifted significantly. Lead times for H100 GPUs shortened from over 50 weeks in 2023 to 8–12 weeks by the end of 2024, easing supply constraints and reducing urgency among buyers. At the same time, market demand shifted toward larger GPU clusters than those available under the HPE Agreement, making it difficult to secure long-term, reserved contracts at profitable rates.

The expected release of NVIDIA’s H200 Blackwell architecture also caused some customers to delay purchases. Although release timelines were impacted by design issues, the prospect of next-generation technology contributed to hesitancy in H100 acquisition. Competitive pressure from alternative GPU vendors further softened demand and market pricing. Soluna Cloud’s business progressed more slowly than anticipated. Revenues were first recognized in December 2024, with modest growth in early 2025.

During the last six months, Soluna’s engagement with potential financing and operating partners for AI/HPC, has confirmed that rather than continuing the effort to lease and resell GPU/HPC chips, refocusing on Soluna’s core strength- creating, developing, financing and operating its extensive pipeline of potential bitcoin and AI hosting facilities – will create far more value for the company and its shareholders.

In light of these developments, on March 24, 2025, Soluna AL Cloud and the Company, formally notified HPE of its intent to terminate the HPE Agreement and related statement of work, in accordance with the termination provisions outlined in Appendix 1, Sections 8(d) and 8(h)(ii). Subsequently, HPE sent notice to the Company of its termination for cause, effective immediately, due to Soluna AL Cloud’s material breach of its payment obligations that remained uncured for more than thirty (30) days, pursuant to Section 8(b) of the HPE Agreement.

Questions and Answers

What is the exposure to the Company from outstanding customer contracts and SLAs?

As outlined in the summary above, we signed mostly on-demand agreements with customers which include the right to reclaim the GPUs with a notice period. All customers and partners have been notified about the termination and a wind-down process is underway.

What is the exposure to the Company from the termination of the agreement?

Soluna AL Cloud notified HPE about a termination for convenience. This form of termination does not remove the obligation to pay all remaining payments on the contract. Under the agreement, HPE has some obligation to mitigate this exposure by reselling these GPUs to other customers for example. HPE subsequently terminated the agreement for cause, which likewise does not remove the obligation of Soluna AL Cloud to pay all remaining payments on the contract. This obligation (and the guaranty by Soluna Cloud of such obligation) do not have the corporate guarantee of Soluna Holdings, Inc.

Was the $20 million for damages for backing out of the commitments from HPE customers? Is it owed to HPE? Is it an accounting entry or will it be paid to HPE or its customers? Any timeline for this in to cash flow? Any way of backing out of any of this by contesting through contractual clauses?

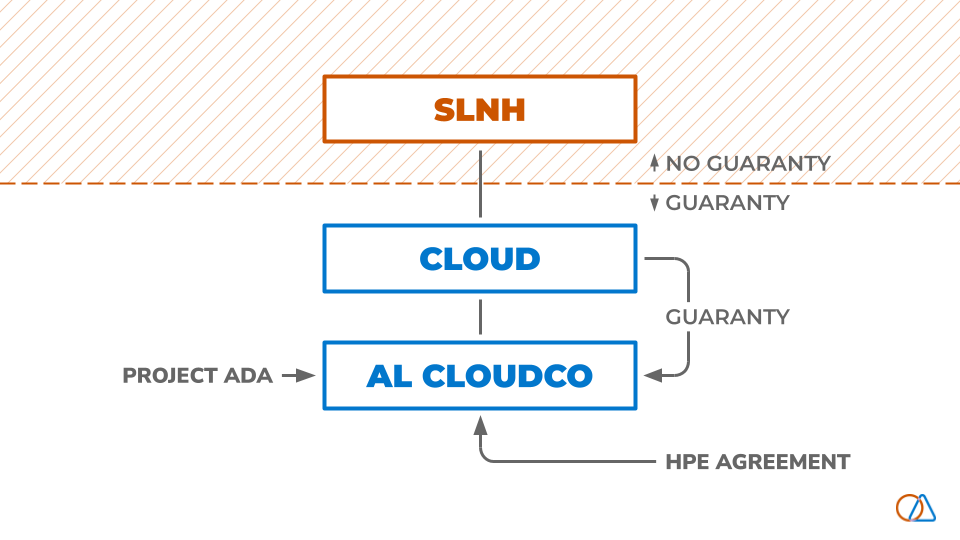

In considering the situation, it is helpful to understand the legal structure of and arrangements between the parties to these agreements. We have included a diagram below to better illustrate these relationships. The HPE Agreement is by and between Hewlett Packard Enterprise (“HPE”) and Soluna AL CloudCo LLC (“AL CloudCo”). AL CloudCo is a wholly owned subsidiary of Soluna Cloud, Inc. (“Cloud” and together with AL CloudCo, the “Cloud Entities”). Cloud provided a separate guaranty for AL CloudCo’s obligations under the HPE Agreement.

The Cloud Entities are separate and distinct legal entities that are subsidiaries of Soluna Holdings, Inc. (“Soluna Holdings”), however, Soluna Holdings did not guarantee any of AL CloudCo’s obligations to HPE under the HPE Agreement or otherwise.

As previously disclosed, on March 24, 2025, AL CloudCo sent a notice of termination for convenience to HPE, which was followed on March 26, 2025, by a notice of termination for cause from HPE to AL CloudCo, which became effective immediately.

In accordance with the terms of the HPE Agreement, upon a termination for cause by HPE, AL CloudCo became obligated to pay HPE the remaining payment stream under the term of the HPE Agreement of approximately $19.3 million as of March 31, 2025 (approximately $20.0 million as of December 31, 2024), including all upfront payments and monthly charges, plus any fees incurred for the terminated Services (as defined in the HPE Agreement).

Because, for accounting purposes, AL CloudCo’s financial statements are consolidated with Soluna’s financial statements, these amounts are fully reflected on the consolidated financial statements of Soluna Holdings, Inc. and its subsidiaries as of December 31, 2024.

HPE could take legal or collections because of AL CloudCo’s default under the HPE Agreement. However, HPE does also have a duty to mitigate damages by reselling GPUs to other customers, for example, which may reduce the Cloud Entities’ overall payment obligations.

Soluna Holdings does not intend to make any payments on behalf of the Cloud Entities in connection with the termination of the HPE Agreement. In addition, since the termination of the HPE Agreement was accounted for in the consolidated financial statements as of and for the fiscal year ended December 31, 2024, Soluna Holdings does not expect any additional entries related to such termination for the fiscal year ended December 31, 2025.

What are the next steps for Soluna Cloud’s business?

Soluna intends to focus on the development of our power pipeline for both Bitcoin Hosting and AI Infrastructure. The Company is pursuing joint ventures with leading data center operators to partner with us on the development of advanced data centers for AI at our project sites.

Will you purchase equipment from HPE? Do they remain a viable vendor for GPU hardware?

HPE retains ownership of the GPUs allowing them to resell them. The contract delivered the equipment to Soluna as a managed service as part of the HPE GreenLake AI business unit.

What impact does this have on the GreenCloud notes used to finance this deal?

As we announced in a Form 8–K filing, there were certain modifications made to the GreenCloud note to ensure that the HPE Agreement termination would have no direct impact on the loan and the Company’s obligations thereunder. The Company expects to continue to service the loan as part of these modifications.

Will this decision negatively impact Soluna’s AI/HPC business or ability to raise capital for future projects?

We do not expect this to impact our reputation as a renewable-energy-powered data center developer. Our core business remains sound and its application to AI remains viable. Our foray into the AI GPU as a Service, while not successful, has helped the Company understand the AI infrastructure market and potential opportunities for our growth. We have active discussions with joint venture partners to develop some of our project pipeline into AI data centers. The partners include data center operators and the leading NeoCloud providers – companies providing GPUaaS – who have a real need for colocation and data center space. By exiting the GPUaaSbusiness, we can be a more collaborative partner for these companies.

What has changed that caused you to apparently pivot away from GPU-as-a-Service?

At launch, the market for NVIDIA H-100 GPU clusters was strong, but it quickly shifted due to falling demand, declining prices, and customer preference for much larger clusters, making it difficult to secure profitable long-term deals. Throughout 2024, improved GPU supply, competition, and anticipation of NVIDIA’s next-gen Blackwell architecture further softened H-100 demand, leading buyers to delay purchases of new GPUs or Cloud commitments. As a result, Soluna’s Cloud business grew more slowly than expected, with limited early revenues and underperformance in its partnership with HPE. As we learned more, it became apparent that deep expertise in chip leasing and resale was not nearly as significant for success in the AI space as expertise in power, land and data center project development.

Will this negatively impact Soluna’s digital assets (Bitcoin Hosting, Bitcoin Mining) business?

We do not expect this to impact our other business lines: Bitcoin Hosting Business, Bitcoin Mining Business, and HPC Business. Each of these businesses are standalone silos. On a consolidated basis this will affect the business in two ways: (1) continued payments to GreenCloud debt will be required with no offsetting revenue from decommissioned HPE business, (2) although confined to the Soluna Cloud subsidiary, potential disruptions from any HPE actions related to their rights under the contract. We do not expect the financials for this agreement to continue as part of our 2025 (and beyond) financials.

Why not renegotiate the HPE contract rather than terminate?

We explored restructuring options with HPE to address the profitability of the service and support scaling for a growing pipeline. Unfortunately, we could not come to an agreement on approaches that would benefit both parties. We appreciate the collaboration with HPE, but we had to do what was best for Soluna and termination was the only option that made sense absent a major restructuring and repricing of the contract.

What was the rationale for the HPE cloud deal at inception?

In 2024, Soluna launched its GPU-as-a-Service business under its subsidiary, Soluna Cloud, with two primary objectives: (1) to gain commercial experience in the AI/HPC market in support of future data center development focused on large language models (LLMs) and other AI workloads; and (2) to capitalize on lower-cost capital to pursue high-growth revenue opportunities in the compute infrastructure market.

How much has Soluna already invested in this? How much revenue did it get? What is the cash loss?

Please see our 2024 10-K and Investor presentation on our Investor Center at SolunaComputing.com.

What is the team’s strategic focus for 2025? Hosting BTC? AI? Does Soluna expect to purchase/rent chips in the future?

We do not currently have plans to purchase or rent GPUs in the near future.

In 2025, we are focused on advancing the following key initiatives in our business segments:

Power Pipeline Expansion – We plan to scale our operational footprint by energizing D2 and commencing construction of the 83 MW Bitcoin Hosting phase of Project Kati. Together, these projects are expected to advance our path toward over 200 MW of operational capacity under management.

AI Infrastructure Development – We aim to form joint ventures with leading U.S. data center developers, including top global infrastructure funds and hyperscaler-aligned development and financing partners. Our initial efforts will focus on launching the 83 MW AI phase of Project Kati, with the goal of establishing our first portfolio of advanced data centers purpose-built for AI workloads.

Project Optimization – We continue to prioritize improvements in profitability, operational efficiency, customer mix, and satisfaction across our existing data centers. Our goal is to drive consistent execution and deliver best-in-class performance for our customers using a new service model called Relentless Stewardship.

Capital Formation – We plan to pursue targeted capital-raising initiatives to support both near-term project development and long-term growth across our platform. The recent Galaxy financing is a good example (link).