In this Q&A, Michael Toporek, CEO of Soluna Holdings (Nasdaq: SLNH), answers stockholders’ and potential investors’ most asked questions.

(If you missed the last one, click here.)

Given recent declines in stock price, some might worry if Soluna is going out of business. Can you speak to the stability of the Company?

I cannot comment on market speculation. I can say that we have nearly completed the construction of 50MW of additional capacity behind the meter (“BTM”) at our facility in Texas, known as Project Dorothy. This facility is co-located with a wind farm and has the capacity to grow to 100MW. The Company expects to begin energizing this site in the fourth quarter of 2022. As we all know, as a facility gets energized it begins to generate cash. This is a transformative event for Soluna as we expect it to double our MW under management and prove the economics of Soluna’s BTM strategy.

Even during low Bitcoin prices, Soluna is focused on growing our business through the market cycle. We continue to attract capital from long-term investors, for example, the $5 million in Series B Preferred we raised in July. We believe that this strategy will provide the Company the ability to build facilities and ultimately grow the business at low build costs, potentially offering greater returns on invested capital.

When will Soluna have ERCOT approval to energize?

Discussions with ERCOT remain active and constructive, and we continue to be optimistic that we will meet our goal of energizing Project Dorothy by the end of this year.

Does Soluna generate controllable load or ancillary services revenue by altering its load as requested by the grid?

Yes, we will be able to generate revenue from ancillary services. We are working with the necessary parties to gain approval and begin implementing a plan to generate revenue from ancillary services at Project Dorothy.

Ancillary revenue streams are a key component of mitigating power costs. Once we are able to offer products and services that will generate ancillary revenues, we believe that such opportunities have the potential to drop Dorothy’s net power costs significantly, putting the site in the lowest 5% of site power costs on the BTC network. A number of the projects in our development pipeline will likely have significant ancillary revenue associated with them from inception.

Does Soluna have any other near-term projects it expects to build out?

Soluna is making progress on two other development sites in Texas known as Project Kati and Project Cynthia that can be rapidly developed BTM in the ERCOT market. Project Kati is a 150MW project and Project Cynthia is a 130MW project. We do not have more detailed construction timelines to share at this time.

How is your business plan flexible enough to adapt to market dynamics that change quickly?

We currently have about 50MW between the Project Marie and Project Sophie sites in Kentucky. About 10MW of that is under a hosting agreement that expires at the end of September 2022. In addition, we expect to have 50MW of capacity at Project Dorothy in the fourth quarter. The current market environment is characterized by a glut of machines and a shortage of plugs. We are actively assessing hosting and proprietary mining operations for all plugs to determine the best return on invested capital. This could involve the movement of our prop mining machines or additional hosting agreements. This planning is active and happening in real-time. We believe we have a strong economic asset base that we intend to fully exploit in this market.

How will you finance two additional sites in this market?

We have an agreement with private equity firm Spring Lane Capital for up to $35 million in project financing, for which we intend to cover three locations, the first being Project Dorothy, for which we have recently entered into a contribution agreement. As previously disclosed, assuming Spring Lane is comfortable with the economics of the two additional facilities, we expect they will similarly commit up to $12 million to each of these projects (a total of up to $24 million). If obtained, this is a significant down payment on getting these sites financed and built. The business plan for each of these sites will be determined by market conditions in terms of phased build-out and hosting versus prop mining.

What is your opinion of the stock price and recent action?

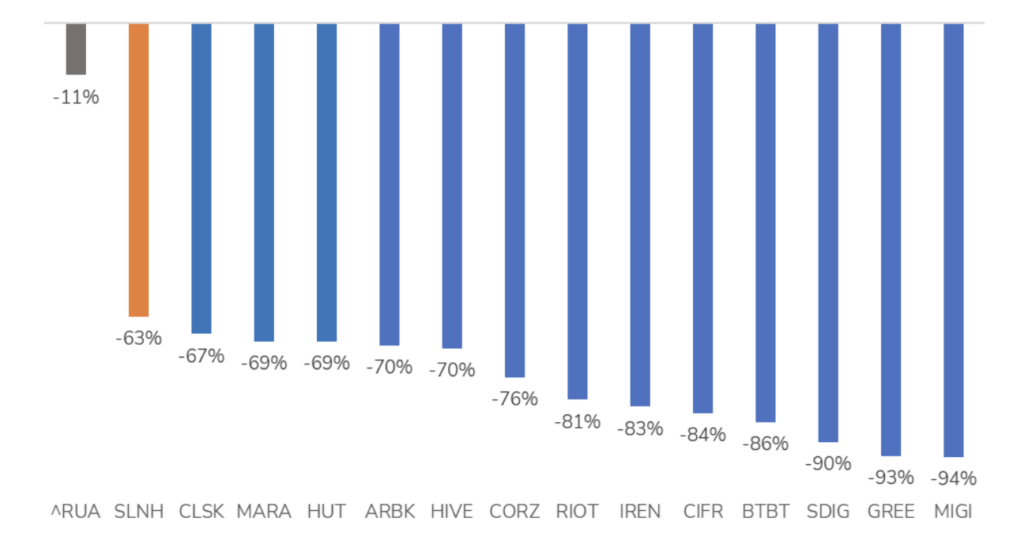

We are not in a position to comment on recent stock prices. All we can say is that over the last year Soluna’s stock price has performed in the top quartile relative to its peer group (see chart below).

1 Year Stock Price Performance as of August 26, 2022

We are focused on building enterprise value and building a valuable company that generates strong returns for investors. Unfortunately, stock price fluctuation day to day is subject to many market variables that we cannot control.

The margin on hosting is usually lower than prop mining? Why would you consider it?

We look at our business in terms of return on invested capital. Basically, how much capital do we have invested and when do we generate enough cash to get our capital back. We generally target 2 to 3 years. Both miners and the infrastructure to host provide the pricing for us to hit these targets in today’s environment. One stream is steadier than the other, and to balance risk and return we may seek to alter the mix of both revenue streams from time to time.

Does Soluna offer a dividend reinvestment plan?

To our knowledge, Soluna is the only public company in the sector to have paid its investors dividends as we have done for the preferred stock (SLNHP). Some investors have inquired if they could take all or a portion of their monthly cash dividend in Soluna common stock. If we were to consider this it would be at the investor’s discretion as of the record date. Investors would be able to elect what proportion of their dividend would be paid in stock. The price would be set at the 5-day VWAP prior to the record date. In addition, to encourage long-term investors, the Company would consider offering a 10% discount on the 5-day VWAP. There is currently no plan to do this since there is a certain administrative burden that the company would incur and we are unsure if there would be sufficient participation to justify the costs of setting it up. We will, however, continue to assess the demand for such an opportunity.

Thank you for submitting your questions!

If you’re reading this and haven’t had a chance to ask your question, it’s not too late.

Fill out this form, or drop your questions on Twitter @SolunaHoldings to have your questions answered in our next AMA installment.

LISTEN to our podcast Clean Integration where we cover this topic and many others.

LEARN more about Soluna by visiting our website.

WATCH our latest updates and insights on YouTube.

FOLLOW us on Twitter and LinkedIn to continue the conversation.

Forward Looking Statements

Certain statements in this series of “Frequently Asked Questions” may constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements reflect management’s current expectations, as of the date of these FAQs, and are subject to certain risks and uncertainties that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Any statements herein that are not statements of historical fact may be forward-looking statements. When we use the words “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” “should,” “could,” “may,” “will,” and similar words or phrases, we are identifying forward-looking statements. Actual results could differ materially from those expressed or implied by such forward-looking statements as a result of various factors, including, but not limited to those risk factors set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, and other risks and uncertainties that may be detailed from time to time in the Company’s reports and other documents filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. Except as required by law, the Company assumes no obligation to update or revise any forward-looking statements.